What is SIP Mutual Fund Calculator?

The pull of mutual funds is strong over the past generation because of the safety, stability and regular returns that it offers. There are various types of schemes and investment paths under mutual funds for people to choose from which adds to its appeal. It suits people who want to invest their money, without any hassle. Let us now shift focus to SIP.

What is Systematic Investment Plan?

Investments are usually carried out by you making a lump sum one-time payment for the assets that you are looking to own or want as a part of your portfolio. But a Systematic Investment Plan is a tool under the mutual fund category that allows you the investor to invest your money in parts over a period. You pay installments weekly, monthly, quarterly, or any other way, as mentioned in your contract. Here you will be charged at regular intervals for your investment and further units will be added to your portfolio as per the Net Asset Value. This method has been adopted to make sure that the investor in the volatile market gets the benefit of the dollar cost averaging, wherein they are going to benefit by getting more units for the same price when the markets are down, leaving them with an overall satisfactory total of units held. Apart from making investors disciplined, SIP allows them flexibility. You can increase, decrease or stop your investment amounts as and when you wish and thus this investment is also recommended to retail investors who can’t actively keep on investing time and again.

Features of SIPs

Now that we know SIPs and what they are, it is time to look at their features. Here are some features of SIP that make them stand out in the world of investments.

Safe to Invest

Mutual funds are safe and less risky than other kinds of investment, which already makes them the first choice. Apart from that, the money is cut from your bank account periodically and the investment is made in your choice of scheme. For someone who is new to the investment market and does not have much knowledge about it, they might feel safer and more comfortable when dealing in mutual funds than any other assets which are comparatively more volatile and tricky.

Organized investment path

The investment is not a one-time thing but rather done periodically, and thus you get more flexibility as an investor. Your money is not going out on a daily basis but rather at regular intervals which is yet another benefit for you. SIP makes sure to keep the investor disciplined and organized with its ways and because it follows a particular system you as an investor benefit from getting more units when the markets are down. Yes, at high rates you are allocated lesser units, however, in the end, more often than not you end up scoring more units in total by average.

Small payment amount

Most investment paths are not meant for everyone but that is not the mutual fund way. Here, you can start investing from just 500 rupees and dream of earning big. Whereas in other investment paths it is usually a huge sum that you need to put in so that you are assured of making a great profit. Some investment paths need capital that is not affordable for many and that is why a large number of people turn to mutual funds. Also Read: What is Reverse CAGR Calculator?

Easy to use

The ease of dealing and investing in SIPs is unparalleled because it is a hassle-free process even if you are a beginner and know nothing about it. If you don’t want to voluntarily debit money towards the payment every time, then you can take care of that by setting up auto-debit by informing your bank. This makes the process less manual and, in turn, makes life easier for the investor who does not need to remember or panic about last-minute payments.

Compounding

You can earn money on your earned money. Just like compound interest where you get returns even on your new and interest included amount, similarly, here you can earn more money from your investments by earning money on your interest earned. The primary amount is supposed to be kept invested for a longer period to earn higher interest and then this interest can be reinvested into the scheme and that way you can stand to earn a handsome profit over a longer time period.

More stocks, smaller quantity

Usually diversifying a portfolio can prove to be an expensive affair because buying multiple stocks may require higher capital which might not be readily available to all investors. However, when going the mutual fund way you can diversify your portfolio by owning small quantities of multiple stocks that too at a more affordable price.

Stop or Skip

If you have taken up a recurring plan, then be ready to pay a fine in case you stop making payments towards it. But if you have invested in a SIP then feel free to stop or skip a payment as per your convenience. You won’t be fined nor charged extra. You can increase or decrease the amount you invest periodically, or you can continue with the plan as it is even if you don’t have the amount to invest for a particular installment.

What is SIP Mutual Fund Calculator?

The term SIP mutual fund calculator seems pretty self-explanatory. It is a calculator that is used to calculate the returns that you stand to make on your SIP investment. All you have to do is enter the target income you have in mind or let the calculator tell you an affordable option to earn a fixed income. All you need is a SIP calculator which you can find online just like in the image below then you need to add the necessary details in the calculator and then just put in the numbers and let the calculator do its work. The three main things in a SIP calculator are the sum that you have to invest periodically, say monthly, the number of years that you need to invest for and the expected interest rate that you are looking to make every year. You can add the details as per your calculations and put the numbers in and let the calculator do its work. Usually, investments need to be for a period of 6 months, however the bigger the time period, the higher the profit made.

How does SIP calculator work?

Let’s take some fictional values to get an understanding of how the calculator works. Let’s say the investment amount per month for you stands at 4,000 rupees and the period you are willing to invest for is 10 years. The rate of return stands at let’s say 10% per annum. Now put all these details in the necessary boxes and hit calculate in the SIP calculator. You will come to learn that this investment scenario helps you earn 8.3 lakhs by the time your 10 years are completed. And just by increasing the per month amount to 5,000 rupees, you stand to make 10.3 lakhs. Certain calculators come with an Inflation option that can take into consideration inflation rise and give you a more realistic value of what you stand to earn. You can opt to not use the inflation option if you don’t wish for it.

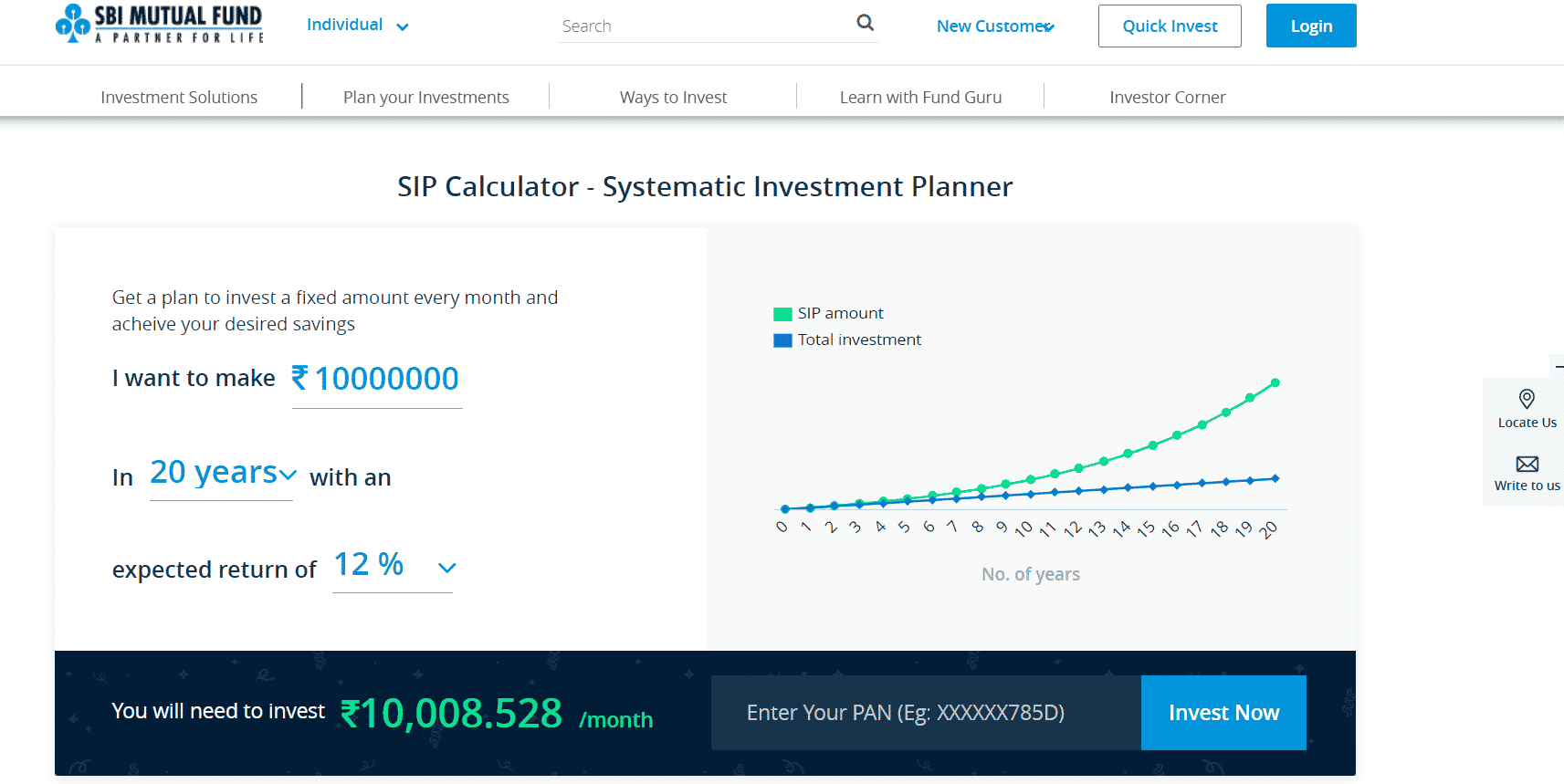

SIP calculator SBI

SIP calculator SBI is an effective tool. You have to enter the details of the money you want to make out of your investment. After that enter the time period of investment that you are looking at and the expected return that you have in mind. By default, the amount to make is set at 1,00,00,000 rupees and the investment period is set at 20 years with a 12% interest rate. You can see that you will need to invest Rs. 10,008.528 per month. You can access this calculator by clicking here. The next calculator is SIP calculator HDFC.

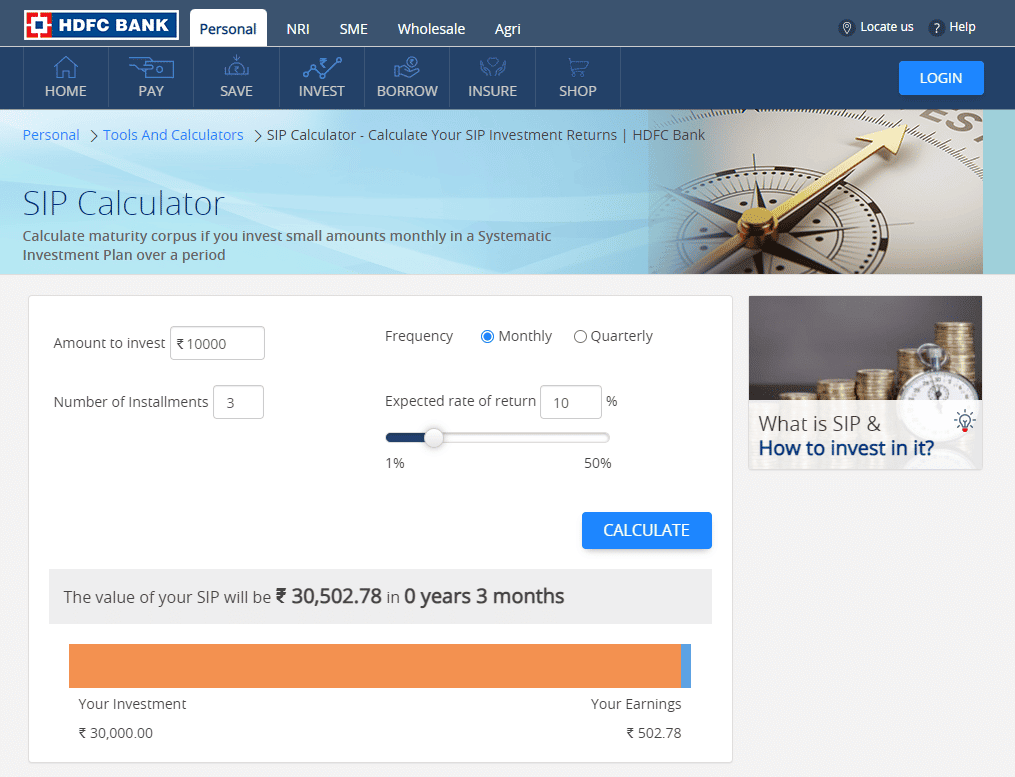

SIP calculator HDFC

HDFC bank is one of the most trusted private sector banks in India. It has an online SIP calculator that you can use. Let us check it out. For example. Let us take a look at SIP calculator HDFC. For example, we have taken investment amount as Rs. 10,000 and number of installments as 3. We have kept rate of return at 10%.

After clicking the calculate button, we will get the SIP value which in this case is Rs. 30,502. You can alter the numbers and calculate your own SIP value. You can use this calculator by going to its official site. Hopefully, you now understand how to use SIP calculator HDFC.

SIP calculator Upstox

Upstox has managed to gain a reputation of being the best online trading platform in India. With a strong user base of 10 million, it offers many facilities which include SIP calculator Upstox. You can go to Upstox official calculator page to use it. By default the monthly investment is set at Rs. 25,000 with a return rate of 12% for a time period of 10 years. According to the calculator you will make Rs. 58,08,477 out of which Rs. 30,00,000 would be your investment and Rs. 28,08,477 your profit. Also Read: What XIRR means in Mutual Funds?

SIP calculator Finology

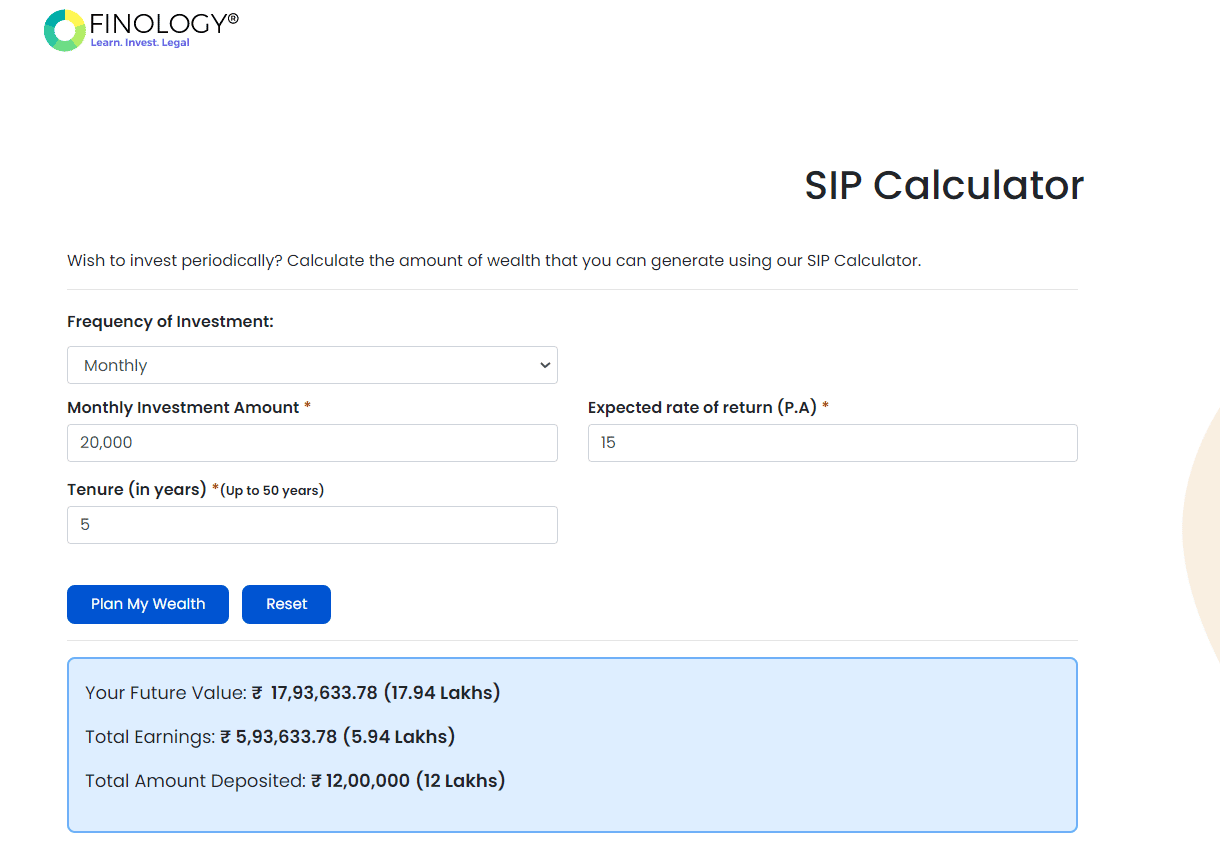

Famous for its stock research tool Finology is slowly gaining ground in India. They offer courses on finance related topics which you can sign up for and become a smart investor. One of their best features is Recipe, which makes an investment plan for you according to your requirements and spending habits so that you can meet your goals. Let us now take a look at SIP calculator Finology. For example, we have put Rs. 20,000 as monthly investment and 15% rate of return for a time period of 5 years which is put under Tenure.

After clicking on Plan My Wealth button in SIP calculator Finology we get the estimated SIP value of Rs. 17,93,633 with earnings of Rs. 5,93,633. You can use SIP calculator Finology by visiting its official page. That was one pricey ride. Who thought mutual funds could get you such huge sums of money in a few decades? Knowing what we now know of SIP it is safe to say that all of us stand a chance to make good money by considering mutual funds like right now. We hope you are now aware of SIP mutual fund calculator and how you can use it. We also used some online calculators like SIP calculator SBI, SIP calculator HDFC, SIP calculator Upstox and SIP calculator Finology to familiarize you with them. SIP can be very useful if used properly but make sure you have a clear understanding of it before investing money in it.